There’s a reason people say that life is “death and taxes.” When you’re in the middle of tax season and juggling all your financial life’s moving parts, it’s easy to feel like the process will never end. No sooner have you filed last year’s tax returns before the next tax season starts ramping up.

No matter your frustrations, it’s essential to take the tax process —-and the IRS —seriously. Small mistakes are common but avoidable. Other errors can be categorized as negligence, while the worst mistakes can put you on the hook for fraud. Don’t despair. Armed with the right information, you can find an accountant you can trust, avoid common mistakes, and stay on top of anything that might become a problem for you down the road. However, if you’ve been charged with an IRS violation, it’s imperative to partner with an attorney who can provide you the representation you deserve.

Avoidable Tax Mistakes

Missing the deadline

If you’re self-employed, you may file quarterly estimates on your yearly income, while other people may wait until the April 15th deadline to file their annual tax returns. If you miss the deadline, you may be subject to penalties, fines, or deductions from your return. With taxes, it’s best to think ahead. If you fear you may miss the deadline, it’s always a smart idea to file for an extension ahead of time.

Writing the wrong Social Security number (SSN)

Most people have their Social Security number memorized, but that doesn’t mean that everyone writes it correctly every single time. Your SSN is your tax ID number. As such, it’s essentially your tracking number. Financial institutions, your employer, and other entities use your SSN to report important information to the IRS. If you fail to write your SSN correctly, you could face delays and additional paperwork until you rectify your mistake.

Failing to sign your legal name

If you don’t use your legal name regularly, it can be an easy mistake to write your commonly used name on your tax returns. The name on your tax return has to match the name on your SSN card and your bank account before your income tax return is released. For this reason, it’s vital to double-check your forms as you complete them and confirm that you have accurately signed your legal name.

Mathematical mistakes

Taxes are math, and it’s easy to make mistakes when you’re doing math by hand or dealing with many numbers. One of the most common math mistakes is failing to carry the 1. If you’re not confident in your ability to accurately calculate the numbers on your tax return, it’s a good idea to have a CPA or someone comfortable with mathematics look over your forms before you send them in.

Bank account number errors

Like math mistakes and writing the wrong SSN, transposing your bank account number is another easy mistake to make. Long strings of numbers can be difficult to write accurately, so check and double-check that your bank account numbers are correct. Errors in your bank account numbers could lead to delays in receiving your return.

Mail mistakes

Many people opt for the simplicity of e-filing these days, but if you are faithful to pen and paper, it’s important to double-check your postage and all your forms before mailing in your taxes. Some claims and deductions require additional documents. Don’t cut corners on postage because improperly posted mail will be sent back and lead to unexpected delays.

Tax Fraud

Individuals or entities cheating their taxes is more common than you might think:

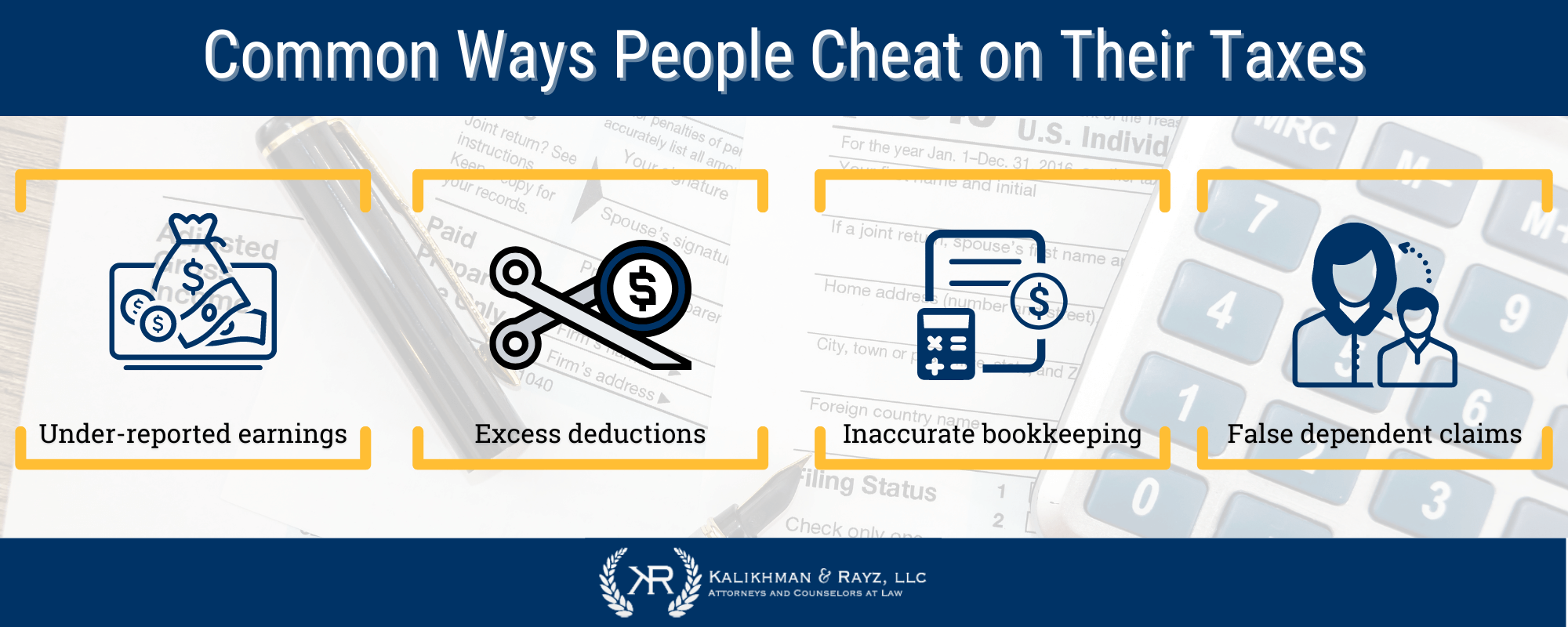

The common ways people cheat on their taxes are:

- Self-employed people tend to underreport their earnings

- Self-employed people may also over deduct

- Keeping separate financial books

- Falsely claiming a dependent

Even still, the IRS reports that less than 6% of all tax filings are fraudulent.

What Are the Penalties for Tax Fraud?

The IRS is relatively understanding when it comes to petty mistakes on taxes, but that doesn’t mean that your mistakes won’t trigger an audit. Even if you’re being audited, it doesn’t mean that your tax agent is immediately suspecting you of fraud, but they are taking a closer look at your mistakes and keeping an eye out for inconsistencies.

An avoidable and careless mistake can cost you as much as a 20% penalty on your tax return, while outright fraud can come with penalties as high as 75%. In addition to the aforementioned civil penalties, gross examples of tax fraud may even come with jail time.

Auditors are looking for “badges of fraud.” Common badges of fraud include:

- Multiple sets of financial books

- Lack of bookkeeping

- Altered checks

- Overstated deductions

While tax issues are notoriously difficult to catch, these mistakes can put a target on your back. If you’re being audited, our criminal lawyers are here for you. Contact us today to learn more about how we can help you through sticky tax situations.